- Publisher |

- Dvorak/Horowitz

- Media Type |

- audio

- Podknife tags |

- Business,

- Business News,

- Investing,

- Stock Market

- Categories Via RSS |

- Business,

- Business News,

- Careers,

- Investing,

- News

This podcast currently has no reviews.

Submit ReviewA flood of earnings and a flood in SOFLA

Lunch with the Feds this week. Last week’s Fed minutes tell an interesting story.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Earnings Are Out - Flooding in SOFLA - we have pictures - Lunch with the Feds - Fed minutes tell an interesting story - Re-Announcing CTP for Goldman Sachs (glitch last week)

Market Update - Going Sideways - Banks post decent results - but doesn't include post-crisis (bank run) - Tesla, Netflix earnings and and next week gets busy - Yellen making some noise - nosing in wrong business - Rates - Moving wrong direction (remains massively inverted)

Yields - Yields on 3-month T-Bills have reached new post-2007 highs of 5.06%+

Fed Minutes - Fed expects banking crisis to cause a recession this year, minutes show - Fallout from the U.S. banking crisis is likely to tilt the economy into recession later this year, according to Federal Reserve documents released Wednesday. - Though Vice Chair for Supervision Michael Barr said the banking sector "is sound and resilient," staff economists said the economy will take a hit. - "Given their assessment of the potential economic effects of the recent banking-sector developments, the staff's projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years," the meeting summary stated.

Apple Follow Up - We discussed potential store closures??? - Apple opens first retail store in India - Cook was there in Mubai this week to take selfies and smile

China - GOLD AND JEWELS - Jewellery and precious metals consumption in China soared 37.4% in March from a year earlier underpinning a 13.6% jump for the quarter and topping the list of items that stoked a surge in first-quarter retail sales, official data showed on Tuesday. - "Economic fundamentals, risk aversion and the recovery of domestic consumption all drive the investment demand for jewellery and precious metals," said Pang Xichun, research director at Nanjing RiskHunt Investment Management Co.- China's economy grew at a faster-than-expected pace in the first quarter, with retail sales rising 10.6%, beating forecasts for a 7.4% increase by a large margin.

Bank Earnings - Generally okay - withing tolerance range - None seems to include post Bank run (Tighter standards) - Not much in guidance that is useful

Bank Of America - Earnings: 94 cents per share versus 82 cents per share expected - Revenue: $26.39 billion versus $25.13 billion expected - Bank of America said its net interest income jumped 25% to $14.4 billion during the quarter, driven by benefits from rising rates and loan growth. - Stock up marginally

Goldman Sachs - Reports Q1 (Mar) earnings of $8.79 per share, excluding non-recurring items, $0.73 better than the S&P Capital IQ Consensus of $8.06; revenues fell 5.5% year/year to $12.22 bln vs the $12.66 bln S&P Capital IQ Consensus. - Provision for credit losses was a net benefit of $171 million for the first quarter of 2023, compared with net provisions of $561 million for the first quarter of 2022 and $972 million for the fourth quarter of 2022. - Global Banking & Markets generated quarterly net revenues of $8.44 billion, driven by strong performances in Fixed Income, Currency and Commodities (FICC) and Equities, including record quarterly net revenues in Equities financing. - Net revenues were $12.22 billion for the first quarter of 2023, 5% lower than the first quarter of 2022 and 15% higher than the fourth quarter of 2022. The decrease compared with the first quarter of 2022 reflected lower net revenues in Global Banking & Markets, partially offset by significantly higher net revenues in Asset & Wealth Management and Platform Solutions.

Schwab - Charles Schwab beats by $0.03, reports revs in-line - Reports Q1 (Mar) earnings of $0.93 per share, $0.03 better than the S&P Capital IQ Consensus of $0.90; revenues rose 9.5% year/year to $5.12 bln vs the $5.13 bln S&P Capital IQ Consensus. - Commentary from Co: "Maintaining the capital and liquidity required to support Schwab's long-term growth remains our primary balance sheet objective. We increased our quarterly common dividend by 14% to $.25 per share and returned capital via common and preferred stock repurchases. Even with the accelerated capital return during the first two months of the quarter, our Tier 1 Leverage Ratio finished at 7.1%. - In light of recent events within the U.S. banking sector, and the resulting regulatory uncertainty, we have decided to pause our active buyback program. That being said, opportunistic capital return is still an important component of our ‘through the cycle' financial formula. - Ultimately, we believe the current headwinds will prove transitory and we remain well positioned to deliver long-term value to our stockholders." - Company was also very adamant about its low duration bond holdings - they did not buy out at the long end during this cycle - Why is company still in the doghouse?

Meanwhile... - Estimates are for a drop (withdrawal) of deposits approaching $520 billion for banks in the past year - $60 billion + in the 1st quarter of 2023 - Where did the money go? - Brokerages, Treasuries

Netflix - Netflix sees Q2 $2.84 vs $3.08 S&P Capital IQ Consensus Estimate; sees revs $8.24 bln vs $8.47 bln S&P Capital IQ Consensus Estimate - Netflix Q1 operating margin came in at 21.0% vs 19.9% prior guidance; guides to Q2 operating margin of 19.0% - Netflix global streaming paid net adds in Q1 were +1.75 mln

Apple Bringing The Heat - Apple on Monday launched its Apple Card savings account with a 4.15% annual percentage yield. - It requires no minimum deposit or balance, Apple said, and users can set up an account from the Wallet app on their iPhones. - This is in cooperation with Goldman - What does this do to the bank accounts that are still paying little or no interest? --- FYI - The national average APY on savings accounts is just 0.35%, according to the Federal Deposit Insurance Corporation,

J& J Earnings - Earnings per share: $2.68 adjusted, vs. $2.50 expected - Revenue: $24.75 billion, vs. $23.67 billion expected - J&J is now forecasting 2023 sales of $97.9 billion to $98.9 billion, about $1 billion higher than the guidance provided in January. The company raised its full-year adjusted earnings outlook to $10.60 to $10.70 per share, from a previous forecast of $10.45 to $10.65.

Best Buy - This week, many store workers that specialize in selling more complex products such as computers and smartphones, dubbed “consultants” inside the company, were told their jobs would be eliminated, according to people familiar with the situation. - Employees in ‘consultant’ roles told they can reapply for other internal jobs or receive severance - So now little technical help available at the store.... - Why shop there anyway? All online... Curation?

Lulu - Lululemon Athletica Inc. is exploring a sale of Mirror, the fitness-equipment maker it acquired for $500 million in 2020, according to people with knowledge of the matter. - Meanwhile from March earnings: The Co. beats by $0.14, beats on revs; guides Q1 EPS above consensus, revs above consensus; guides FY24 EPS above consensus, revs above consensus. Additionally, lululemon athletica upgraded to Buy from Neutral at Citigroup and upgraded to Outperform from Neutral at KGI Securities. Lastly, lululemon athletica placed on Analyst Focus List at JP Morgan. - is something going on that they need to get rid of Mirror? OR just Mirror is bleeding them?

This Week - Luncheon with Richard Clarida (Former Vice Chair) - Talking in circles - some interesting insight - AH question was a bout the "wordsmithing" that goes on at the FED. --- Asked if there is a PR team that does some kind of A/B testing on the words that will be used to try to sway the public. Asked about "transitory", "anchored", "sound and resilient", and now DEFLATION. - He confirmed and agreed that there is a good amount of wordsmithing that goes on. Also provided a discussion of the history of the use of the word deflation. (Volker) Didn't really answer much else. - - Did make the point very clearly that just listen to Fed Chair Powell and what he says to understand what the Fed is going to do.

Yellen Making Some Noise - U.S. Treasury Secretary Janet Yellen said banks are likely to become more cautious and may tighten lending further in the wake of recent bank failures, possibly negating the need for further Federal Reserve interest rate hikes. - Since when does the Treasuty Secratary talk about Fed policy - Everyone lost their minds when Trump was pushing Fed/commenting

Flood Pictures

Ask Us Anything - Selection 1. Someone mentioned on another podcast that if "they" goes with a CBDC to replace the U.S. dollar, all mortgage contracts would be null and void - is there any validity to that? 2. Quad, Northern VA, Smart or dumb- My company offers ESPP at %15 stock discount twice a year. Max contribution is %15 gross from each check. I go tax exempt all year and contribute max to the ESPP, then cash that out to pay my taxes (about net 10% guarantee gain). Your thoughts? 3. how do you feel about yellens recent comments on raising the national debt to 50 Trillion 4. If you could tell your 15 yr old self 1 thing about finance, what would it be.

Love the Show? Then how about a Donation?

ANNOUNCING a NEW

CTP for Goldman Sachs

ANNOUNCING a NEW

CTP for Goldman Sachs

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Banks need some inflows – giving away prizes for deposits.

Earnings season is about to begin – looking for a significant downside for growth.

Yields ticking lower as recession fears bump inflation worries.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Easter and holiday season coming to an end... - A NEW Closest to The Pin Announcement - Bond yields way down - what does that mean? - Free Toasters Making a comeback - Gold, metals, alts, COINS!

Market Update - Falling Yields - may be a bit much - Employment report - mixed bag - Earnings season starts this week - Big Banks - Apple news - PC Demand

DONATIONS - April Donations - Bring May Flowers

Earnings Season Prep - Going to be some bad guidance... If actions by companies any guide - Example - Google letter about 2008 and getting in advance so they can say - we are ahead of this... - Banks - what good can they say? Or maybe at worst levels? - S&P 500 Estimates - looking for -7% YoY growth for earnings

How Bad? Tech bad... - Apple Mac shipments fell 40.5% in the first quarter of 2023, compared with the same time the prior year, market intelligence provider IDC said. --- Apple’s worldwide PC market share dropped between the first quarter of 2022 and the first quarter of 2023, from 8.6% to 7.2%, according to IDC data. - All five of the largest computer makers — Apple, ASUS, Dell, HP and Lenovo — saw double-digit drops in first-quarter shipments, reflecting weaker demand and persistent inventory woes. But Apple’s decline was the biggest of the bunch. - Taiwan Semi - slowing production as demand is not there

Employment Report - March nonfarm payrolls 236K vs consensus 239K; prior revised to 326K from 311K - March unemployment rate 3.5% vs consensus 3.6%; prior 3.6% - March avg. hourly earnings 0.3% vs.consensus 0.3%; prior 0.2% - March avg. workweek 34.4 hours vs consensus 34.5; prior 34.5 - 25% of the employment gains were in services (restaurants, bars and hotels)

Home Price Outlook - Moody's expects 98% of major markets to post a home price decline over the coming year. - According to Zillow, tight supply will make it hard for home prices to fall much heading forward. - Through the first two months of 2023, the biggest home price drops were found in markets like Austin (down 2.5% since December), Boise (down another 2.4%), Las Vegas (down another 2.4%), Phoenix (down another 2.2%), and San Jose (down another 2.1%). - Western US home values seem the most detached from fundamentals according to reports.

Bond Yields - Dropped due to banking crisis - Even with FED pressing on - still lower (3.4% on 10-year)| - Heavy Inversion - Recession now the play versus inflation worries

Sky Is Falling - Starlink seems to have a problem - Satellites are falling out of orbit and coming back dosn to earth (something Elon will never do) - Astrophysicist Jonathan McDowell tracks SpaceX's satellite activity, and said that at present "at least 14" of the company's devices were "on their way down". - Reports show that the satellite in question likely burned up as it attempted to reenter the Earth's atmosphere, meaning traces of it will be incredibly hard to find.

AS the Sky is Falling ... - Investors snapping up alternatives - Gold >$2,000 - Silver in rally mode - Bitcoin > $30,000 (but 1 bitcoin is still 1 bitcoin - Ether > $1,900

Meanwhile - Fed is full CYA mode - Federal Reserve Bank of New York President John Williams said on Monday that financial system troubles that drove the central bank to provide large amounts of credit to banks is not collateral damage from the Fed’s aggressive effort to lower inflation. - Williams said he viewed the trouble at the two banks as unique in nature and unlikely to reflect broader trends in the financial system. - That said, Fed officials have said that banking sector stress will likely weigh on the economy, as financial firms pull back on lending. That in turn could result in lower activity levels while also helping to further cool price pressures.

Favorite Story - Apple Robbery - The Alderwood Mall Apple Store was closed when the burglary took place. - The entire operation was clean and employees were unaware of it until the next morning. The robbers did not enter the store through the front but created an entry from an adjoining bathroom wall of an espresso machine outlet. The entry through the espresso store was conducted through the front door as thieves pried open the door. - Once the burglars gained entry into the espresso store, they cut through the wall of the bathroom that lead straight to the Apple Store. - According to the news outlet. the burglars cut a 24 by 18 hole into the wall that opened in the back room of the Apple Store. The entire operation was seamless as the robbers took almost 436 iPhone models and an unknown number of Apple Watch and iPads. Altogether, almost $500,000 worth of Apple products were stolen from the Apple Store.

Peeping Tesla - A California Tesla owner sued the electric carmaker in a prospective class action lawsuit accusing it of violating the privacy of customers. - The lawsuit in the U.S. District Court for the Northern District of California came after Reuters reported on Thursday that groups of Tesla employees privately shared via an internal messaging system sometimes highly invasive videos and images recorded by customers’ car cameras between 2019 and 2022. - What are people doing in their cars ???? - Reuters reported that some Tesla employees could see customers "doing laundry and really intimate things. We could see their kids," citing a former employee. (That's it?)

More Tesla - Because there is ALWAYS MORE TESLA - Tesla cut process again. - The cuts ranged from 1.9% on the performance version of the Model 3 to 5.6% on the basic version of the Model S. - The move follows repeated comments in recent months by Chief Executive Elon Musk that Tesla would focus on lowering prices to spur demand and had seen success in sparking orders with global discounts introduced in January. - SOOOOO, demand continues to wane?

NYC - WTF? - NYC restaurants impose 90-minute time limits on diners - even if they want to stay and order more.... - Started during COVID - now stretching due to shrinking profit margins - What is wrong with the ? If anything?

Used Car - Going Up Again (h/t Thomas Thornton)

Toasters Coming Back? - U.S. banks are trying to woo depositors by offering signing bonuses to open new accounts or deposit money on a regular basis. - Capital One Financial Corp is advertising a $100 bonus for opening a new savings account and keeping more than $10,000 in it for 90 days. - Citizens Financial Group is offering a $25 bonus for customers who put in $100 a month for three months and maintaining a minimum balance

Tupperware - Issues a "going concern" notice - Founded in 1942! - Tupperware shares fell nearly 50% Monday following a bleak warning that its future is looking murky. - In a regulatory filing late Friday, the container maker said there's "substantial doubt about the company's ability to continue as a going concern," and that it's working with financial advisers to find financing to stay afloat. - The New York Stock Exchange also warned that Tupperware's stock is in danger of being de-listed for not filing a required annual report. - So, must be a buy according to Reddit rules... tight? (TUP)

Dalai Lama - What was he thinking? - "A video clip has been circulating that shows a recent meeting when a young boy asked his Holiness the Dalai Lama if he could give him a hug," said a statement on the exiled leader's Twitter account, which has 19 million followers. - Then asks the boy if he would suck his tongue.

PSA - The FBI recently warned consumers against using free public charging stations, saying crooks have managed to hijack public chargers that can infect devices with malware, or software that can give hackers access to your phone, tablet or computer. - "Avoid using free charging stations in airports, hotels or shopping centers," a tweet from the FBI's Denver field office said. "Bad actors have figured out ways to use public USB ports to introduce malware and monitoring software onto devices. Carry your own charger and USB cord and use an electrical outlet instead."

American IQs - Americans’ IQ scores are trending in a downward direction. In fact, they’ve been falling for over a decade. - According to a press release, in studying intelligence testing data from 2006 to 2018, Northwestern University researchers noticed that test scores in three out of four “cognitive domains” were going down. This is the first time we’ve seen a consistent negative slope for these testing categories, providing tangible evidence of what is known as the “Reverse Flynn Effect.”

Love the Show? Then how about a Donation?

ANNOUNCING a NEW

CTP for Goldman Sachs

ANNOUNCING a NEW

CTP for Goldman Sachs

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

The end is near – AI taking over they say…

OPEC+ Suprise cuts – not the best tine for that move.

Some bankers may be in hot water after their recent poor judgement.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - 1st Quarter scores gains - Gold and Silver breaking out - Never let a good crisis go to waste? - More layoffs... Big names making news - OPEC Surprise !

Market Update - Tech BIG winner 1Q 2023 - Yields down -- even though inflation still high - Reflex trades - all tied to rates - More layoffs coming - AI names making a run - with all chatter about AI doomsday ----- FRIDAY MARKETS CLOSED

Twitter Logo Update = Dodgecoin Ramp

Happy Passover and Happy Easter (The Usual Holiday Price Drops for Political Purposes) - Bought 5 dozen eggs from Walmart yesterday for $12.75 - Matzah prices coming down as well

AI Doomsday ! - They are coming for your job -- The letter, issued by the non-profit Future of Life Institute and signed by more than 1,000 people including Musk, Apple co-founder Steve Wozniak and Stability AI CEO Emad Mostaque, called for a pause on advanced AI development until shared safety protocols for such designs were developed, implemented and audited by independent experts. - Elon Musk and a group of artificial intelligence experts and industry executives are calling for a six-month pause in training of systems more powerful than GPT-4, they said in an open letter, citing potential risks to society and humanity. - The letter also detailed potential risks to society and civilization by human-competitive AI systems in the form of economic and political disruptions, and called on developers to work with policymakers on governance and regulatory authorities. ---AI and Your JOB - -- Goldman Sachs: The boost to global labor productivity could also be economically significant, and nee estimate that AI could eventually increase annual global GDP by 7%. (Savings from less workers... less workers = less $ to spend) - Goldman Sachs Estimates That 300 Million Jobs Will Be Affected By AI In The Future

QUESTION: Isn't this the same concerns we had in 2000?

AI Banned - Italy has become the first country in the West to ban ChatGPT, the popular artificial intelligence chatbot from U.S. startup OpenAI. - Last week, the Italian Data Protection Watchdog ordered OpenAI to temporarily cease processing Italian users' data amid a probe into a suspected breach of Europe's strict privacy regulations. - How can they do this? Must be workarounds

More Tech - Google to cut down on employee laptops, services and staplers for 'multi-year' savings - Google said it's cutting back on fitness classes, staplers, tape, and the frequency of laptop replacements for employees. - “We've been here before," Porat's email stated. "Back in 2008, our expenses were growing faster than our revenue. We improved machine utilization, narrowed our real estate investments, tightened our belt on T&E budgets, cafes, micro kitchens and mobile phone usage, and removed the hybrid vehicle subsidiary.” - “Just as we did in 2008, we’ll be looking at data to identify other areas of spending that is as effective as they should be, or that don’t scale to our size.” (2008 references???)

McDonalds ? - MCDONALD'S has shut down its offices temporarily as the company reportedly prepares for mass staff layoffs. - Corporate employees were instructed to cancel meetings at its headquarters. - The company said in the memo that the layoffs are intended to make McDonald’s more efficient. - “We have a clear opportunity ahead of us to get faster and more effective at solving problems for our customers and people and to globally scale our successful market innovations at speed,” the company said.

OPEC+ Weekend - OPEC cut production by 1.1m b/d - Now $100 price targets coming - 6% move for crude over past 2 days - Problematic for inflation -

Banking Crisis - Is it all over? - Jamie Dimon’s assessment of the US banking crisis that sent markets careening last month, an episode he predicts is “not yet over” and will be felt for years. - He said US authorities shouldn’t “overreact” with more rules. - Annual Letter: As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come

Tesla - Record quarterly deliveries - BUT, price cuts and less deliveries than expected. - Tesla delivered 422,875 vehicles for the first three months of this year, up 4% from the previous quarter. - This was 36% higher than a year ago. In January, Chief Executive Elon Musk said Tesla could achieve 2 million vehicle deliveries this year, up 52% from last year. - Analysts believe that if they had not done price curs in January, this quarter would have been really ugly - Concern has shifted to margins now

Credit Suisse Takeover - Switzerland’s Federal Prosecutor has opened an investigation into the state-backed takeover of Credit Suisse by UBS Group, the Financial Times reported on Sunday. - The Bern-based prosecutor is looking into potential breaches of Swiss criminal law by government officials, regulators and executives at the two banks, which agreed on an emergency merger last month, the report said citing the authority.

First Republic Bank - Massachusetts regulators have opened an investigation into sales of company stock by top executives at First Republic Bank in the weeks leading up to the recent banking turmoil. - Massachusetts' Secretary of the Commonwealth William Galvin told Reuters his office has subpoenaed First Republic. He is seeking details about the firm's insider trading policies and how officers handled their stock sales from January 1.

Here Comes the Regulation - U.S. Treasury Secretary Janet Yellen said on Thursday that banking regulation and supervisory rules need to be re-examined in the wake of the Silicon Valley Bank and Signature Bank failures to ensure current banking system risks are addressed. - Yellen also called for stronger regulation of the growing non-bank, or "shadow bank", sector, including money market funds, hedge funds and crypto assets. - Yellen said a 2018 roll-back of bank capital requirements and stronger supervision for smaller and mid-size banks with assets below $250 billion should be re-examined. - Better late than never?

Did You Know? - Coca-Cola plant in New Jersey produces $2B worth of cocaine annually thanks to special deal with DEA - The Coca-Cola Company's exclusive license to import coca leaves into the US allows a small chemical processing facility concealed in a peaceful New Jersey neighborhood to manufacture up to $2 billion worth of pure cocaine annually. - The cocaine byproduct is sold to the country's biggest opioid manufacturer, who sells the powder as a numbing agent and topical anesthetic for dentists.

EARNINGS - Earnings season set to begin next week.... Slowly then all at once - JPM kicks it off on April 14

Masters Cold This Weekend - Weather is going to be a problem - Thursday Chance of rain, Friday 100%, Saturday 100% (cold), Sunday 70%

Love the Show? Then how about a Donation?

CTP for TESLA

CTP for TESLA

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Microsoft Activision deal – back in the spotlight.

Bank runs have cooled – but there are still questions.

Resilient – yes, that’s the word Fed officials will use. Over and over to describe banks.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - More Banks - But not to worry - Odds are for RATE CUTS this year starting July - Chili Cook Off - The Results (ask Andrew about the Cocoa) - Crawfish Boil and BBQ this weekend - What is JCD Doing? - Dueling message on Seaweed Blob - Moores law - Coiner - Dies

Market Update - Big Bucks pulled from banks - (they have been screwing depositors for years with low rates) - Big banks getting those Big Bucks - Recession odds increased with all of these problems

A Moment - Gordon Moore, the Intel Corp. co-founder whose theory on computer-chip development became the yardstick for progress in the electronics industry, has died. He was 94.

Bank Notes - Nearly $100 billion in deposits pulled from banks; officials call system 'sound and resilient' - Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell and more than a dozen other officials convened a special closed meeting of the Financial Stability Oversight Council on Friday. --- "The Council discussed current conditions in the banking sector and noted that while some institutions have come under stress, the U.S. banking system remains sound and resilient," the statement said. - Data released Thursday showed that institutions took a daily average of $116.1 billion of loans from the central bank's discount window, the highest since the financial crisis, and have taken out $53.7 billion from the Bank Term Funding Program. Sunday - Kashkari: “The banking system is resilient, and it’s sound,” Kashkari told Margaret Brennan on CBS’s “Face the Nation.” “The banking system has a strong capital position and a lot of liquidity and has the full support of the Federal Reserve and other regulators standing behind it. Now, I’m not saying that all of the stresses are behind us, I expect this process will take some time.”

Controversial - Big banks, advising smaller banks... - The dynamic has put big banks like JPMorgan and Goldman Sachs in the awkward position of playing multiple roles simultaneously in this crisis. Big banks are advising smaller ones while participating in steps to renew confidence in the system and prop up ailing lenders like First Republic, all while gaining billions of dollars in deposits and being in the position of potentially bidding on assets as they come up for sale.

New Programs - Because Banks are Sound - US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, according to people with knowledge of the situation. - AND YET - "I think this is more of a Bear Stearns moment. I think a lot of people, including me, said when they bailed out Bear Stearns, they increased moral hazard. They created an expectation of further bailouts," former FDIC Chair Sheila Bair said Friday - "[The government is] trying to imply that all uninsured are protected, which they don't have legal authority to do, frankly, and this is putting pressure on community banks," she said. "It's really troubling."

First Citizens Buys Silicon Valley bank - SWEETHEART DEAL - First Citizens BancShares is acquiring $72 billion in SVB assets at a discount of $16.5 billion - But even after the deal closes, the FDIC remains on the hook to dispose of the majority of remaining SVB assets, about $90 billion, which are being kept in receivership. - And the FDIC agreed to an eight-year loss-sharing deal on commercial loans First Citizen is taking over, as well as a special credit line for "contingent liquidity purposes,"

Fed heads - All bests are on that cuts are going to happens starting July - We are entering into a problem zone --- Lack of Cred for Fed ---- 150 bps differential between Official Fed expected rate and market Assumptions

Cuts Start July

Heads Roll - Credit Suisse - Saudi National Bank Chairman Ammar al-Khudairy resigned his post on Monday, days after his comments exacerbated the share collapse of troubled bank Credit Suisse. - Al-Khudairy's resignation comes within days of his mid-March comments to Bloomberg that SNB was unlikely to increase its stake in Credit Suisse, at a time when the European lender battled a crisis of investor confidence that plunged its shares.

Homes/Housing - Real-estate firm Zillow Group Inc. is exiting from the home-flipping business, saying that its algorithmic+ model to buy and sell homes rapidly doesn’t work as planned. - The firm’s termination of its tech-enabled home-flipping business, known as “iBuying,” follows Zillow’s announcement about two weeks ago that it was halting all new home purchases for the rest of the year. - At the time, Zillow pointed to labor and supply shortages for its inability to renovate and flip houses fast enough.

Twitter News - Twitter CEO Elon Musk valued his company at less than half the price he purchased it for in a stock option offer to employees last week. - Musk gave stock grants to employees in an email earlier this month that valued the company at roughly $20 billion, a far cry from the $44 billion he purchased the company for last year, according to the Wall St. Journal.

Michigan - Michigan became the first state in decades to repeal its “right-to-work” law when Gov. Gretchen Whitmer (D) signed legislation on Friday to rescind it. - “Right-to-work” laws allow employees at unionized workplaces to opt out of joining a union and or paying dues. Proponents of these types of laws argue that they allow workers to decide for themselves whether to join a union

Port Update - 1st - Need a TRAIN report - Now, 43% less imports were processed at the Port of Los Angeles in February compared to the same time last year. - "We're still in a very strange place with our retail community. Inventories remain very high, new orders coming out of Asia won't pickup until that older inventory is purchased by us, the U.S. consumer," said Gene Siroka, the Executive Director of the Port of Los Angeles. - There has also been a shift away from West Coast imports, which the port is working to address.

In Other News - Fastest Joint roller.... - With nimble fingers and years of practice, Ativat Janmuangthai beat other cannabis enthusiasts to roll a perfect, one-gramme joint in 43 seconds on Saturday, becoming the fastest joint-roller in Thailand's Phuket. - Apart from the title and trophy, the winner, in his 30s, was also awarded a cash prize of 5,000 baht ($146.37).

Seaweed Blob - Debunked - In the past week, numerous news outlets warned of a massive "seaweed blob" destined to take over Florida's east coast. "Massive seaweed bloom starts washing ashore on Florida beaches," the New York Post reported. "A seaweed blob twice the width of the US is heading toward Florida," CNN forewarned. - Dr. Yuyuan Xie uses satellites to study Sargassum, a genus of large brown algae that floats around in island-like masses. "There is no 'seaweed blob.

Microsoft - Activision - The U.K.'s competition regulator on Friday said it has narrowed the scope of its investigation into Microsoft's takeover of Activision, saying it no longer believes the deal will lead to a substantial lessening of competition in the console gaming market.

Walgreens Earnings - Walgreens revenue rises despite sharp decline in demand for Covid tests, vaccines - Somehow the company says that revenue on prescriptions up as they are open for more hours. - Don't people get the same amount of prescriptions no matter the pharmacy hours?

Crypto Sewer Remains Open - Major cryptocurrency exchange Binance and executives, including CEO and founder Changpeng Zhao, have been sued by the U.S. Commodity Futures Trading Commission (CFTC) for regulatory violations - Binance's compliance program has been "ineffective" and the firm, under the direction of Zhao, told employees and customers to go around compliance controls, the CFTC said. It also accused Binance's former Chief Compliance Officer Samuel Lim of aiding and abetting Binance's violations.

EV Losses - Ford Motor said Thursday its electric vehicle business lost $2.1 billion last year on an operating basis, a loss that was more than offset by $10 billion in operating profit between its internal combustion and fleet businesses. - 2023 will unfold along similar lines, forecasting an adjusted loss of $3 billion for its EV unit - Just throwing losses to that segment to make others look better?

Why Not? - 4G to arrive on the moon this year - Nokia is preparing to launch a 4G mobile network on the moon later this year, in the hopes of enhancing lunar discoveries — and eventually paving the path for human presence on the satellite planet. - The network will be powered by an antenna-equipped base station stored in a Nova-C lunar lander designed by U.S. space firm Intuitive Machines, as well as by an accompanying solar-powered rover.

Love the Show? Then how about a Donation?

CTP for TESLA

CTP for TESLA

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

No rest for bankers – weekend overload to quiet markets.

COCO bond rug pull – billions lost

The Fed in a no-win position this week. Rate decision meeting Wednesday.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Full blown banking crisis - S&P P/E still above 17+ - Fed has big decision tomorrow - Fed/Treasury dusting off financial crisis playbook - Bond yields move - largest since '87 --- Banks joining in the charade - $30 billion - Whatever you do - don't say bailout!

Market Update - Banks failing - forced merger over weekend - Fire sale for deposits - big win for some banks - COCO / ATI Bond massacre - RUG PULL - Tech favored over most other sectors - Goldman says rates hikes over

FED GAME - What will the do tomorrow? - ECB Playbook (raise like nothing happening) - Powell Playbook - raise 0.25% and keep pushing that the data is what they look at - try to save face... - Volker Playbook - ram it - Bernanke Playbook - zero or cut

GAME ON - We are playing the real life Monopoly - Treasury Secretary Yellen says the govy could backstop more deposits if necessary to stop contagion - - Trillions in deposits - how would that work? - - - Monopoly Rules: The Bank: The Bank newer "goes broke." If the Bank runs out of money, the Banker may issue as much more as needed by writing on any ordinary paper. ----- Why would Yellen need to say that ???

Asked on Twitter this week: Why do so many investors enjoy throwing hard earned money into dumpster fires? (Follow John at @therealdvorak and Andrew at @andrewhorowitz)

Dust off the playbook - Plenty of financial crisis moves being made ---- Have I mentioned that this group of Fed leaders could be the worst in my lifetime? - $30 billion from consortium of banks into First Republic ---- NON insured accounts was the push --- NO WAY is this not backstopped by Fed/Treasury as a attempt to boost confidence. TOTAL BS ----- Meanwhile - investors are not impressed. (Stock down from $29 to $17 since announcement) ---- WAIT - NEWS BREAKING MONDAY - JPMorgan Chase's (JPM) Dimon is leading talks with bank executives of others banks about new FRC plans; deal could involve converting previously announced $30 bln in deposits into a capital infusion, according to WSJ ----- NO Correction out - that may bot be the way they want to go .... Just spitting at the wall with ideas it seems -- Meanwhile after 47% drop yesterday, FRC up 36% Tuesday (still down 90% from peak)

Remarkable - Yields up from ZERO - Earnings down and falling - Global banking crisis - S&P 500 forward P/E at 17.9 - PEG at 1.8!

Credit Suisse COCO - UBS buys for pennies on the dollar - COCO bonds (Contingent Convertible bonds) - wiped out - $17 billion lost as regulators write down bonds to ZERO - COCOs - high-yield investments with a hand grenade attached (AKA ATI bonds) --- They’re essentially a cross between a bond and a stock that helps banks bolster capital to meet regulations designed to prevent failure. They’re contingent in the sense that their status can change if a bank’s capital levels fall below a specified level; they’re convertible because in many cases they can be turned into equity

Forced Merger - Credit Suisse bought by UBS - In a package orchestrated by Swiss regulators on Sunday, UBS Group AG will pay 3 billion Swiss francs ($3.23 billion) for 167-year-old Credit Suisse Group AG and assume up to $5.4 billion in losses. (80% discount) - The Swiss central bank said Sunday's deal includes 100 billion Swiss francs ($108 billion) in liquidity assistance for UBS and Credit Suisse.

Fed Decision - Holding 2-day decision on rates today and tomorrow - 65% chance of a 0.25% hike - EuroZone hiked 0.50% last week as they did not want to appear nervous - Interesting that 1/2 of the QT since last April reversed in one week - GOLDMAN: “In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March.”

Deals Deals Deals -A subsidiary of New York Community Bancorp has entered into an agreement with U.S. regulators to purchase deposits and loans from New York-based Signature Bank, which was closed earlier this month. - The Federal Deposit Insurance Corporation said the deal would see Flagstar Bank, the subsidiary, assume substantially all deposits and certain loan portfolios, and all 40 of Signature Bank's former branches. The FDIC said roughly $60 billion of the bank's loans and $4 billion of its deposits will remain in receivership. - NYCB up 35% on the news.

More Deals - Banks for Sale! - The U.S. Federal Deposit Insurance Corp (FDIC) is planning to relaunch the sale process for Silicon Valley Bank after failing to attract buyers in its latest auction, with the regulator seeking a potential break-up of the failed lender, according to people familiar with the matter. - Banks may get to cherry pick and get some real deals here...

Winners and Losers - Bank of America Corp. took in more than $15 billion in new deposits in a matter of days, emerging as one of the big winners after the collapse of three smaller banks dented confidence in the safety of regional lenders. - Schwab claims it too in $$$$$$$$$ - Money moving from one place to the other - the big will get too Bigger to fail...

After the Fact - Shoes Again - A Singapore shoe recycling project will be subject to surprise inspections following a Reuters investigation that found footwear it donated to the scheme was not recycled, Singapore's minister of culture said. - Presented with Reuters findings, Dow and Sport Singapore opened an investigation and later terminated the contract of Yok Impex, a local textile exporter that was subcontracted to collect shoes from donation bins.

Two Sides of Mouth... - On one hand, banks out with talk about how they are getting in deposits or not losing anything meaningful. - On the other - Banks sought record amounts of emergency liquidity from the Federal Reserve over recent days in the wake of the failure of Silicon Valley Bank and Signature Bank, which in turn helped undo months of central bank efforts to shrink the size of its balance sheet --- Banks took an all-time high $152.9 billion from the Fed's traditional lender-of-last resort facility known as the discount window as of mid-week last week, while also taking $11.9 billion in loans from the Fed's newly created Bank Term Lending Program. - - - The discount window jump crashed through the prior record of $112 billion in the fall of 2008, during the most acute phase of the financial crisis.

QT- In Full QE Mode

Side Trip - A trademark dispute over a poop-themed dog toy shaped like a Jack Daniel's whiskey bottle coming before the U.S. Supreme Court could redefine how the judiciary applies constitutional free speech rights to trademark law. - Jack Daniel's Properties Inc, owned by Louisville, Kentucky-based Brown-Forman Corp, is appealing a lower court's decision that Phoenix-based VIP Products LLC's "Bad Spaniels" chew toy is an "expressive work" protected by the First Amendment. - The toy mimics Lynchburg, Tennessee-based Jack Daniel's famous whiskey bottles with humorous dog-themed alterations - replacing "Old No. 7" with "the Old No. 2, on your Tennessee Carpet" and alcohol descriptions with "43% Poo By Vol." and "100% Smelly."| - Seems other similar dog toys - Jamuttson, Barker's mark, Star Pups, White Paw, Pup Light, Pups Blue Ribbon Beer, Houndessey, Chewlulu Hot Sauce, Dr. Pooper, Poopsie

VETO - As Expected - President Biden vetoes bill that would have repealed rule that allows money managers to consider climate change and other ESG factors on retirement investments - Go ahead and invest in made up nonsense

What The....?? - The European Commission has drafted a plan allowing sales of new cars with internal combustion engines that run only on climate neutral e-fuels, in an attempt to resolve a spat with Germany over the EU's phasing out of combustion engine cars from 2035. - Such vehicles would have to use technology that would prevent them from driving if other fuels are used, the draft said. This would include a "fueling inducement system" to stop the car from starting if it was fuelled by non-carbon neutral fuels, it said. - Carbon-neutral fuel is fuel which produces no net-greenhouse gas emissions or carbon footprint. In practice, this usually means fuels that are made using carbon dioxide (CO2) as a feedstock. (Biofuels, Hydrogen) --- BACK TO HORSE DRAWN CARRIAGE?

OH Fauker - The owner of Dubai-based tobacco business Al Fakher has hired Rothschild & Co to advise it on strategic options, including a possible initial public offering, two sources familiar with the matter said. - Al Fakher is owned by Advanced Inhalation Rituals, a private company that is majority owned by London-based Kingsway Capital.

Australian? - Australian members who purchased their Peloton device via Affirm financing are in for some good news: Affirm is waiving the balance of their outstanding loans. - This is a result of Affirm deciding to cease operations in Australia last month

Love the Show? Then how about a Donation?

CTP for TESLA

CTP for TESLA

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Banks get smoked as depositors run scared.

Fortunately we get a Sunday Night STICK SAVE!

We have some bones to pick – bad math and even worse work ethics.

Where are the bargains? We have some thoughts.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Back from Central America! - Largest bank failure since 2008! - Fed will keep raising until something breaks - HELLO!!!!!!!!!!!!! - Worst Fed Ever! - General lack of any business sense - math clearly not a priority in last generations - - No attention to detail - oversight sucks- management is limp - Sunday Night STICK SAVE! (A joint statement from the various regulators involved said there would be no bailouts and no taxpayer costs associated with any of the new plans. )

Market Update - Capitalism is Dead - Moral Hazard Lives On! - 2-day panic attack with region banks - SVB Blowup - DJIA down for the year - California Banking system is imploding - RUN-ON-Bank - CPI - not slowing down too much - 6% YoY - Everyone now banking on less Fed hikes due to banking crisis - or none... Or cuts! (85% chance for 0.25% increase next week)

Coming up this week on Andrew's TDI Podcast - Guest, Anthony Scarramucci

BONE TO PICK - All these tik-tok nubes - want to be a millionaire but have no idea what that means - LET me explain something from someone who works with lots of money all the time... It takes work and then more work - - You can't just make it, you need to keep it. That is just as hard. ---- Making it is not just seeing it on social media - it is a grind and something special - hard work - which it seems is not what people want. ----- Sit at home, no oversight, playing on phone, personal time and personal boundaries that are above work AND not watching the details. --- This is what creates the mess we see today - Then we want government to bail us out! Childish!

Assuming everyone knows what happened. Right? - Banks started to get squeezed as assets/loan valuations got crushed under higher rates - Fed pushed hard and banks did not risk adjust - Bad oversight - SVB - Moodys was going to downgrade, Theil makes some noise about problems, stock offering to raise capital, sold bonds at loss - run on bank - Started with other banks and the problems from overlevearaging with Crypto - all the dominoes falling had to impact firms (tech pulling cash to meet needs, other companies trimming up) - Realization hit that regional banks could have more problems

The Fed is Actually Looking At Itself - EPIC lack of oversight, blinders on as usual - The Federal Reserve Board on Monday announced that Vice Chair for Supervision Michael S. Barr is leading a review of the supervision and regulation of Silicon Valley Bank, in light of its failure. The review will be publicly released by May 1. - "The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve," said Chair Jerome H. Powell. - "We need to have humility, and conduct a careful and thorough review of how we supervised and regulated this firm, and what we should learn from this experience," said Vice Chair Barr. - There will be findings, many many months out as to how they could have done better, but nothing will come of it. ----- Fox guarding the hen house. Should be independent but Fed is above it all - right?

Late Call - Or is it Early? - Moody's cuts outlook on U.S. banking system to negative, citing 'rapidly deteriorating operating environment' - The firm, part of the big three rating services, said it was making the move in light of three key failures that prompted regulators to step in Sunday with a dramatic rescue plan for depositors and other institutions impacted by the crisis. - "We have changed to negative from stable our outlook on the US banking system to reflect the rapid deterioration in the operating environment following deposit runs at Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank (SNY) and the failures of SVB and SNY," Moody's said in a report.

Lots of comments - Jeffrey Gundlach on CNBC says there might be disinflation in the near term, but new backdrop for Fed policy is inflationary; says Fed will raise rates 25 basis points - Former US Treasury Secretary Larry Summers tells Bloomberg that there will be more financial aftershocks - President Biden says deposits at SIVB and SBNY will be there and are safe; says management of banks will be fired; no losses will be borne by the taxpayers, money will come from fees paid to FDIC; investors in banks will not be protected; will ask Congress to strengthen bank regulation - Bill Ackman tweets "Our economy will not function effectively without our community and regional banking system. Therefore, the FDIC needs to explicitly guarantee all deposits now. Hours matter."

Government Intervention - In addition the backstopping SVB’s deposits, federal regulators also announced efforts on Sunday to stabilize the wider banking system. One of those is the Fed’s Bank Term Lending Program, which will allow banks to exchange certain high-quality assets for cash without booking mark-to-market losses. - JCD - Buy AH bonds at maturity value even though underwater - Just killed capitalism

More 0n Intervention - IT IS A BAILOUT - “We’ve changed the system,” economist Mohamed El-Erian, - “Depositors should not worry. Your deposits are fine,” he said. “It is almost impossible now to go back on unlimited deposit guarantee.” - So much for the $250,000 and how is unlimited backstop paid for ??? FDIC?

Thought Exercise - Who would want to keep $ with regional and small banks after this? --- If unlimited backstop of deposits for smaller banks - why would anyone keep money at big banks? ---- Will all banks have unlimited backstop? Who will pay for that? ----- Why not just have the government as the bank?

KBE/KRE Banking ETF - Down 20% -Month to Date - Regional Banks - OOOOOH - - Signature Bank (SBNY.O) dropped about 23%, while San Francisco-based First Republic Bank (FRC.N) fell 15%. Western Alliance Bancorp (WAL.N) tumbled 21% and PacWest Bancorp (PACW.O) dropped 38% after those stocks were halted several times due to volatility. --- That was Friday! - MONDAY Below..... (Saw a nice bounce Tuesday - even with a general downgrade for the industry by Moody's)

FRC First Repub Bank -61.82% WAL.PA Western Alliance Bancorp -46.20% PACWP PacWest Bancorp Pfd -44.62% MCB Metro Bank Hldg Corp -43.46% DPST DX Dly Regional Bks Bull 3X -36.28% FRC.PJ First Republic Bank/CA -35.34% FRC.PN First Republic Bank/CA Pfd -29.59% FRC.PH First Rep Bk San Fran CA Pfd H -28.35% CMA Comerica Inc -27.65% FRC.PI First Rep Bk SF -27.13% KEY KeyCorp -26.95% FRC.PM First Republic Bank/CA -26.76% CNOBP CONNECTONE BANCORP INC NEW DEP -26.21% ZION Zions Bancorp -25.87% BOH.PA Bank of Hawaii Corp -25.42% FRC.PK First Republic Bank/CA -25.34%Holy Interest Rates - IN REVERSE

Of interest - An explosion in trading in a type of equity derivative security in recent months has prompted Wall Street players and a major clearing house to examine the potential risks it poses, according to two sources familiar with the matter. - So-called zero day to expiry options (0DTE), which refers to contracts that expire in less than 24 hours, offer retail and institutional traders a relatively cheap, though high-risk, way to bet on intra-day swings in stock prices. They could be tied to the price of indices, exchange traded funds or single stocks. - Some have warned that this type of option, which offers an opportunity for traders to amplify market bets, could cause an extreme selloff.

How Does This Work? - WWE is in talks with state gambling regulators in Colorado and Michigan to legalize betting on high-profile matches - WWE is working with the accounting firm EY to secure scripted match results in hopes it will convince regulators there's no chance of results leaking to the public - Betting on the Academy Awards is already legal and available through some sports betting applications, including market leaders FanDuel and DraftKings, although most states don't allow it

JetBlue - The Justice Department on Tuesday sued to block JetBlue Airways' $3.8 billion proposed takeover of budget carrier Spirit Airlines, the Biden administration's latest attempt to prevent industry consolidation. - JetBlue's plan would eliminate the unique competition that Spirit provides—and about half of all ultra-low-cost airline seats in the industry—and leave tens of millions of travelers to face higher fares and fewer options

Yellen on Climate - Climate change is already having a major economic and financial impact on the United States and may trigger asset value losses in coming years that could cascade through the U.S. financial system, Treasury Secretary Janet Yellen - Yellen told a new advisory board of academics, private sector experts and non-profits there has been a five-fold increase in the annual number of billion-dollar disasters over the past five years, compared to the 1980s, even after taking into account inflation. - They can't predict a bank meltdown 2 days out - how can they

More ESG - The Senate last Wednesday passed a bill to overturn a Labor Department rule that permits retirement fund managers to weigh climate change and other factors when making investments on behalf of retirement plan participants. - Biden vows to VETO

Fatso - More than half of the world's population will be overweight or obese by 2035 without significant action, according to a new report. - The World Obesity Federation's 2023 atlas predicts that 51% of the world, or more than 4 billion people, will be obese or overweight within the next 12 years. - Rates of obesity are rising particularly quickly among children and in lower income countries, the report found.

Sweet Finale - March Flavor of the month at Baskin Robbins - Chick’n & Waffles, its take on a “deconstructed brunch classic - The dessert is made with buttermilk waffle-flavored ice cream and crispy chick’n and waffle bits sprinkled in, with swirls of bourbon maple syrup. - This ice cream doesn’t actually come with bits of chicken. As the company explained, the crunchy bits are only made to “mimic the taste of fried chicken.”

Love the Show? Then how about a Donation?

CTP for TESLA

CTP for TESLA

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

China making moves. Elon gets his crown back and reversal of fortunes.

March is just ahead – rates could spoil the party.

Baby Bonds are back on the menu…

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Lots of News - same old... - China making moves - Elon gets the crown back - Jamie Dimon Speaks Up - Cool Update From Apple - And Baby Bonds ....

Market Update - A down month - short and out - Large Cap Growth - Beating Large Cap Value this year (small caps tied) - S&P 500 up ~ 4% for 2023 NASDAQ 100 up 10%! - Bonds - taking back some of the last month gains - Gold, Silver walking back on higher USD - Switcheroo

***NO SHOW NEXT WEEK****

Inflation - Not Giving Up - - The U.S. Federal Reserve may hike interest rates to nearly 6%, BofA Global Research said, as strong U.S. consumer demand and a tight labor market would force the central bank to battle inflation for longer. - PPI, CPI and PCE come in hot... - Don't think this is all over, but clearly not moving as fast - looks like we will settle in this area for a while

Vape Wars - Altria Group Inc. is in discussions to acquire vaping startup Njoy Holdings Inc. for at least $2.75 billion in cash, according to people with knowledge of the situation. - A deal could be announced as soon as this week, said the people, who asked not to be identified because the talks are private. There is also $500 million in follow-up payments if Njoy hits certain regulatory milestones, the people said. - Altria recently wrote down the value of its investment in Juul to $450 million. The decision to end the noncompete “maximizes our flexibility to compete in the e-vapor space while maintaining our economic interest in Juul,” Altria said in a statement. - BUT - original investment was $13 billion - GENIUS PLAN - kill the vaping industry so cigarettes are back in vogue

China Area - Great slow play for markets... - Turn from ZERO-Covid to 100% - then keep rolling out more and more - Hong Kong will drop its COVID-19 mask mandate, chief executive John Lee said on Tuesday, in a move to lure back visitors and business and restore normal life more than three years after stringent rules were first imposed in the financial hub. (945 days) - ---- Egg Freezing - A member of China's top political advisory body said she would propose allowing unmarried women to access egg freezing as a measure to preserve their fertility after the country's population fell last year for the first time in six decades. ----------- Lu's recommendations come as authorities try to bolster a faltering birth rate with incentives including expanding maternity leave, financial and tax benefits for having children as well as housing subsidies.

More China - China Renaissance Holdings said in an exchange filing on Sunday that its missing chairman and star dealmaker Bao Fan was currently cooperating with relevant Chinese authorities conducting an investigation. - Reuters previously reported, citing sources, that authorities took Bao away earlier this month to assist in an investigation into a former colleague, Cong Lin, the company's former president.

Even More China - Chinese authorities have urged state-owned firms to phase out using the four biggest international accounting firms, signaling continued concerns about data security even after Beijing reached a landmark deal to allow US audit inspections on hundreds of Chinese firms listed in New York.

Target Earnings - Target (TGT) reported a quarter similar to Walmart's (WMT) last week with a solid Q4 beat on the top and bottom line offset by weak guidance for Q1 and FY23. Q4 adj. EPS fell 41% from an impossible comp while comp sales grew 0.7% - Both were much better than expected. Adj. earnings are expected to grow 37% this year with flat sales in Q1 and FY23. - Mgmt forecasted a wide range of sales for Q1 and 2023 given the uncertain macro; they don't want to have to warn about results like they did last year. The setup for most retailers remains challenging after significantly overearning in 2021.

He's Baaaack! - Elon is once again the richest person in the world - Also the most chatty person in the world - May be one of the most annoying people in the world

Ukraine Surprise Visits - First Biden - Now Yellen - U.S. Treasury Secretary Janet Yellen swept into Kyiv on Monday on a surprise visit to reaffirm U.S. support for Ukraine in its struggle against Russia's invasion and promote U.S. economic aid that is bolstering Ukraine's war effort. - Some people think it is just to get an overdue check/payments (But, for which side?)

Holy Interest Rates

RecycleGATE - Recycled shoe program with DOW checmical - fraud? - Promised to harvest the rubberized soles and midsoles of donated shoes, then grind down the material for use in building new playgrounds and running tracks in Singapore. (or parks for kids) - Reuters tracked 10 pairs they donated via secret tracker and ALL ended up in second hand store in Singapore

Oil slumps - But... - Russia has halted supplies of oil to Poland via the Druzhba pipeline, Daniel Obajtek, chief executive officer of Polish refiner PKN Orlen, said on Saturday. - The pipeline, which supplies oil to Poland and Germany, as well as to Hungary, Czech Republic and Slovakia, was excluded from sanctions to help countries with limited options for alternative deliveries. - Excluded as not good for us - so we will not protest that item ------- Morgan Stanley has raised its global oil demand growth estimate for this year by about 36%, citing growing momentum in China's reopening and a recovery in aviation, but flagged higher supply from Russia as an offseting factor.

Global oil consumption is now expected to increase by about 1.9 million barrels per day (bpd), versus its previous 1.4 million bpd forecast

Jamie Dimon Speaks - Dimon said he expects that interest rates could "possibly" remain higher for longer, as it may take the central bank "a while" to get to 2% inflation. - JPMorgan Chase CEO Jamie Dimon said Thursday that the Federal Reserve has lost some control of inflation, but noted the U.S. economy continues to show signs of strength."- Dimon said he's not currently breaking out the recession playbook, as he is encouraged by the strength of the U.S. economy. - "The US economy right now is doing quite well. Consumers have a lot of money. They're spending it. Jobs are plentiful," Dimon said. "That's today. Out in front of us, there's some scary stuff. You and I know there's always uncertainty. That's a normal thing."

Apple - THIS - Apple Inc. has a moonshot-style project underway that dates back to the Steve Jobs era: noninvasive and continuous blood glucose monitoring. - The goal of this secret endeavor — dubbed E5 — is to measure how much glucose is in someone’s body without needing to prick the skin for blood. After hitting major milestones recently, the company now believes it could eventually bring glucose monitoring to market, according to people familiar with the effort. - Does not seem that this technology is available to the public yet - still in development

Baby Bond idea is back - Democratic lawmakers in Washington are renewing a proposal to give every American child $1,000 at birth. - The "baby bond" funds, called American Opportunity Accounts, would then be topped off with up to $2,000 per year, depending on a family's income. - The accounts would be federally insured and managed by the U.S. Department of the Treasury. - Account holders would be able to access the funds once they turn 18 to pay for eligible uses, such as higher education or homeownership. ----- Taxpayer transfer - interesting but stupid

How Do We Feel About THIS? Gene Editing (Different than CRISPR?) - Moderna Inc will collaborate with privately-owned Life Edit Therapeutics Inc under an agreement to discover and develop mRNA gene-editing therapies, the companies said on Wednesday. - The tie-up will apply Life Edit's diverse collection of new technology for gene editing with the Moderna mRNA platform that was behind its COVID-19 vaccine. - Under the agreement, the companies will collaborate on research and preclinical studies funded by Moderna to develop curative therapies for some of the most challenging genetic diseases.

No Bueno - U.S. payment giants Visa and Mastercard are slamming the brakes on plans to forge new partnerships with crypto firms after a string of high-profile collapses shook faith in the industry - Both Visa and Mastercard have decided to push back the launch of certain products and services related to crypto until market conditions and the regulatory environment improve

US Child Labor - U.S. officials said the Labor Department had seen a nearly 70% increase in child labor violations since 2018, including in hazardous occupations. In the last fiscal year, 835 companies were found to have violated child labor laws. - The maximum civil monetary penalty is currently just $15,138 per child, the administration noted in a press release, a figure that's "not high enough to be a deterrent."

Love the Show? Then how about a Donation?

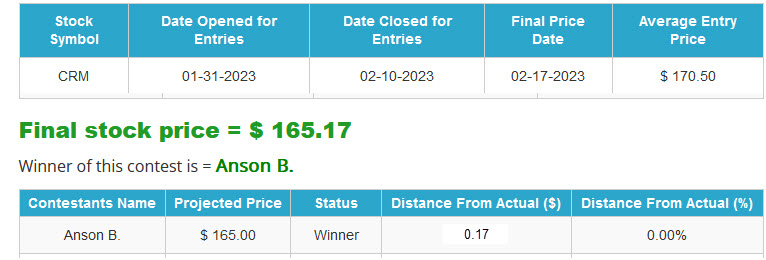

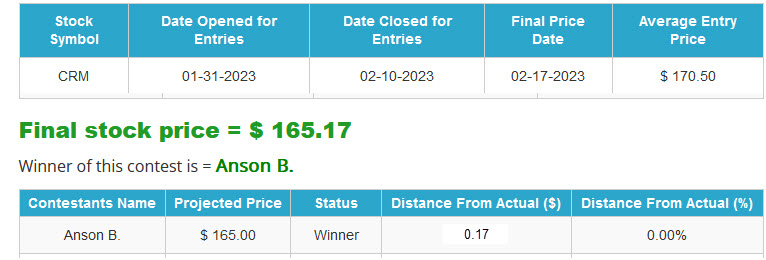

THE WINNER of CTP - SALESFORCE (CRM)

THE WINNER of CTP - SALESFORCE (CRM)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Markets are feeling the pain of a Fed that just can’t make up its mind.

Earnings from retail – not so good.

Global warming is the reason for this all!

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - A quick apology to Hobby Lobby - Inflation ticking up - CPI and PPI not what the market wanted - Change up, this Zip Code - now most expensive in country - Arctic melt is coming - Doomsday Glacier - WHAT? Water BillFlation - Announcing the Winner of the CTP !

Market Update - Bullard and Mester - Not liking the markets euphoria (50bps talk coming back) -- Ever since they opened their mouth - market been in a tailspin - Bird Flu - expanding - watch out chicken and egg prices - Tesla flying high - stock back in vogue - All-time high's for this country's main stock market - Earnings finishing off - mixed bag, but points to concerning quarters to come

Bad Bullard (H/T Bespoke)

Continuing on.... - Worst day of the year today... - S&P 500 Down 2%, DJIA off by 700pts (2%, NASDAQ down 2.5% - 10-year climbing toward 4% again| - Blame placed on unusual strength of the economy - turning better last several weeks.

Water Bill - $1,578 this month at the house - that is inflation! - Full Story - No Leaks

Hot Real Estate - Miami’s Star Island is now the nation’s most expensive neighborhood while the number of New York City areas where buying a home would set you back at least $1 million is on the decline, according to a new survey. - The average price of a single family home on Star Island, the man-made enclave off the coast of Miami Beach that is home to celebrities including Shaquille O’Neal, Gloria Estefan, and Rosie O’Donnell, was valued at an eye-popping $40.2 million as of December, according to Zillow. - 71% increase over 3 years - Star Island is now four times as expensive as Beverly Hills Gateway in Beverly Hills - NY real estate not lagging behind by much --- January average rent for Manhattan apartment - ALL TIME HIGH

Bird Flu - Could bolster inflation (food) again - Outbreaks of the virus have continued in North and South America, Europe, Asia and Africa - Farmers thinking about vaccines - once unheard of - A company farm in Weld County, Colorado, was infected twice within about six months, killing more than 3 million chickens, Rust said. He thinks wind blew the virus in from nearby fields where geese defecated.

Twitter - The Taco Bell of social media - introducing a new product update almost daily - Twitter said on Friday it will allow only paid subscribers to use text messages as a two-factor authentication (2FA) method to secure their accounts. - The company believes phone-number-based 2FA is being abused by "bad actors," - Twitter owner Elon Musk tweeted "Yup" in reply to a user tweet that the company was changing policy "because Telcos Used Bot Accounts to Pump 2FA SMS," and that the company was losing $60 million a year "on scam SMS."

Glacier melting - Antarctica's vast Thwaites Glacier - nicknamed the Doomsday Glacier - say warm water is seeping into its weak spots, worsening melting caused by rising temperatures - Thwaites, which is roughly the size of Florida, represents more than half a meter (1.6 feet) of global sea level rise potential, and could destabilize neighboring glaciers that have the potential to cause a further three-meter (9.8-foot) rise. - Is this concern all about the displacement of the above the line ice?

Brexit - Who Cares - The FTSE 100 is at an all-time high. - With all of the problems in Europe, world... ALL TIME HIGH - Obviously the best decision England made was to leave the EU

Cisco Earnings - The company that is all about IoT - Earnings: 88 cents per share, adjusted, vs. 86 cents per share as expected by analysts, according to Refinitiv. - Revenue: $13.59 billion, vs. $13.43 billion as expected by analysts, according to Refinitiv. - Cisco's total revenue grew 7% year over year in the quarter, which ended Jan. 28, according to a statement. Net income decreased about 7% to $2.77 billion. - The company called for fiscal third-quarter adjusted earnings of 96 cents to 98 cents per share and 11% to 13% revenue growth. (much better than expected) - benefiting from BUY AMERICAN (or don't buy China?)

More Earnings - Dillard's -9.2% heads sharply lower following earnings; dragging down other department store chains: KSS -7.6%, M -5.4%, JWN -3.8% - - Reports Q4 (Jan) earnings of $14.51 per share, excluding items, $5.66 better than the single analyst estimate of $8.85; revenues rose 0.7% year/year to $2.13 bln vs the $2.15 bln S&P Capital IQ Consensus. ----- DO NOT TRADE THIS STOCK - Low Float, manipulated - Home Depot - Not a bad quarter - guides very defensively --- For the first time in several years, HD's comparable sales declined on a yr/yr basis, coming in at -0.3% for the quarter. While the company did lap a challenging yr/yr comp of +8.1%, the 6.0% drop in customer transactions this quarter, on top of a 3.4% decline in the year-ago quarter, points to weakening demand, particularly in the do-it-yourself (DIY) business. - Wal- Mart - Not bad, maybe conservative guidance? ---- Walmart beats by $0.20, beats on revs; comps +8.3% above guidance; guides Q1 EPS below consensus; guides FY24 EPS below consensus - Coinbase - Earnings: Loss of $2.46 per share, vs. loss of $2.55 per share as expected by analysts, according to Refinitiv. Revenue: $629 million, vs. $590 million as expected by analysts, according to Refinitiv. ----- Revenue plunged nearly 75% from a year earlier as the so-called crypto winter continued to drag on the price of cryptocurrencies. The company also reported a (non-adjusted) net loss of $557 million, a year after Coinbase generated net income of $840 million during the peak of crypto adoption. -----???? How is this company losing money if their main competition was recently closed?

JCD Nails It - Norfolk Southern CEO Alan Shaw told CNBC he thinks it's safe for families to return to East Palestine, Ohio, nearly three weeks after toxic chemicals were released following a train derailment earlier this month. - Shaw said the company so far removed about 450 cubic yards of contaminated soil and secured about 1.1 million gallons of contaminated water. He said the company will continue to "do the right thing for this community" and see the recovery effort all the way through. He did not lay out a time frame. - US Govy trying to get ahead of it - pointing and wagging fingers, blaming Norfolk Southern

UK - 4-Day - British companies trialling a four-day working week have mostly decided to stick with it after a six-month pilot in what campaigners for better work-life balance view as a breakthrough. - Employees at 61 companies across Britain worked an average of 34 hours across four days between June and December 2022, while earning their existing salary. - Of those, 56 companies, or 92%, opted to continue like that, 18 of them permanently.

420 Stocks ...

CLICK for list of "Pot Stocks"

Stocks to watch: CGC, STZ, TLRY, CRON, MJ, NBEV

Love the Show? Then how about a Donation?

ANNOUNCING THE WINNER

CTP - SALESFORCE (CRM)

ANNOUNCING THE WINNER

CTP - SALESFORCE (CRM)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) - PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

CLICK HERE FOR MORE CHARTS ON TRADING VIEW

CRYPTO LIMERICKS

JCD Score ()

FED LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

The sky is falling – literally.

We are seeing markets applaud spending cuts – but how far does that reach?

An update on inflation and the Fed’s latest shenanigans.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up - Superbowl - thoughts on adverts/halftime? - Jesus Gets Us - Big news at the BOJ - Crypto Under Fire - AI frenzy seems over already - Kanye West Fallout continues - Soft Landing - Really?

Market Update - Inflation ticks up again - UFO sightings and not much concern (Aliens) - Biden Eco Team shuffle - Inflation comes in a bit hot - markets shrug - What is making market move? Interesting insight - Parade of Fed speakers this week - mostly trying to sell their story (markets deaf to it)

Happy Valentines Day! - Great time for a donation of either $214 or even $14 - Anyone that donated $214 will get a personally signed copy of my book - The Disciplined Investor - Essential Strategies for Success

Soft landing - A soft landing by a central bank is when "the central bank tightens monetary policy to fight inflation but does not cause a recession." If it causes a recession, then it is a hard landing. - If there is a "soft landing" then there is going to be perpetual higher prices| - How is that possible knowing the economic cycles?

Inflation Update - CPI comes in at 0.50% today (prior was 0.1%) - YoY 6.4% - Some serious concern that inflation may be much more sticky than thought ---- Potential 0.25% increase for more meetings and higher terminal rate - MARKETS DO NOT CARE

Morning Meeting - Breakfast with big shot from Merrill today - Message, it will be messy but just stay invested - made some odd comments about valuation and earnings and just rushed past them - AH had sidebar with him.. Asked about the comment of $200 projected earnings for SP500 - -- Infers P/E forward of 20+ - Asked about his overweight US if better value elsewhere --- He said that makes sense of course, yeah ----- These guys are full of crap

What is actually powering market? - Slashes, Cuts and Layoffs - - - Spending cuts, layoffs and other creative money saving --- Let's take that apart and see what we get - WHY???? Earnings for S&P 500 companies are down 23% YoY

Updates - Yahoo plans to lay off more than 20% of its total 8,600 workforce as part of a major restructuring. - Many other companies are cutting back on CapEX and other expansion plans - Markets applauding when they see companies are practicing fiscal restraint - Financial Services also cutting

ECO Team Shuffle - President Joe Biden has decided to name Federal Reserve Vice Chair Lael Brainard as his top economic adviser, with an announcement coming as soon as Tuesday, people familiar with the matter said. - In addition, according to the people, Jared Bernstein, a member of the Council of Economic Advisers, is considered likely to be named its chair, replacing Cecilia Rouse, who is stepping down.