This episode currently has no reviews.

Submit Review- Podcast |

- Barefoot Innovation Podcast

- Publisher |

- Jo Ann Barefoot

- Media Type |

- audio

- Publication Date |

- Jun 13, 2017

- Episode Duration |

- 00:58:15

Here’s a question: Would you like to file your taxes with just a keystroke, after your electronic devices automatically organized all your information and prepared the return? Here’s another -- do you think you’ll still be driving, five years from now?

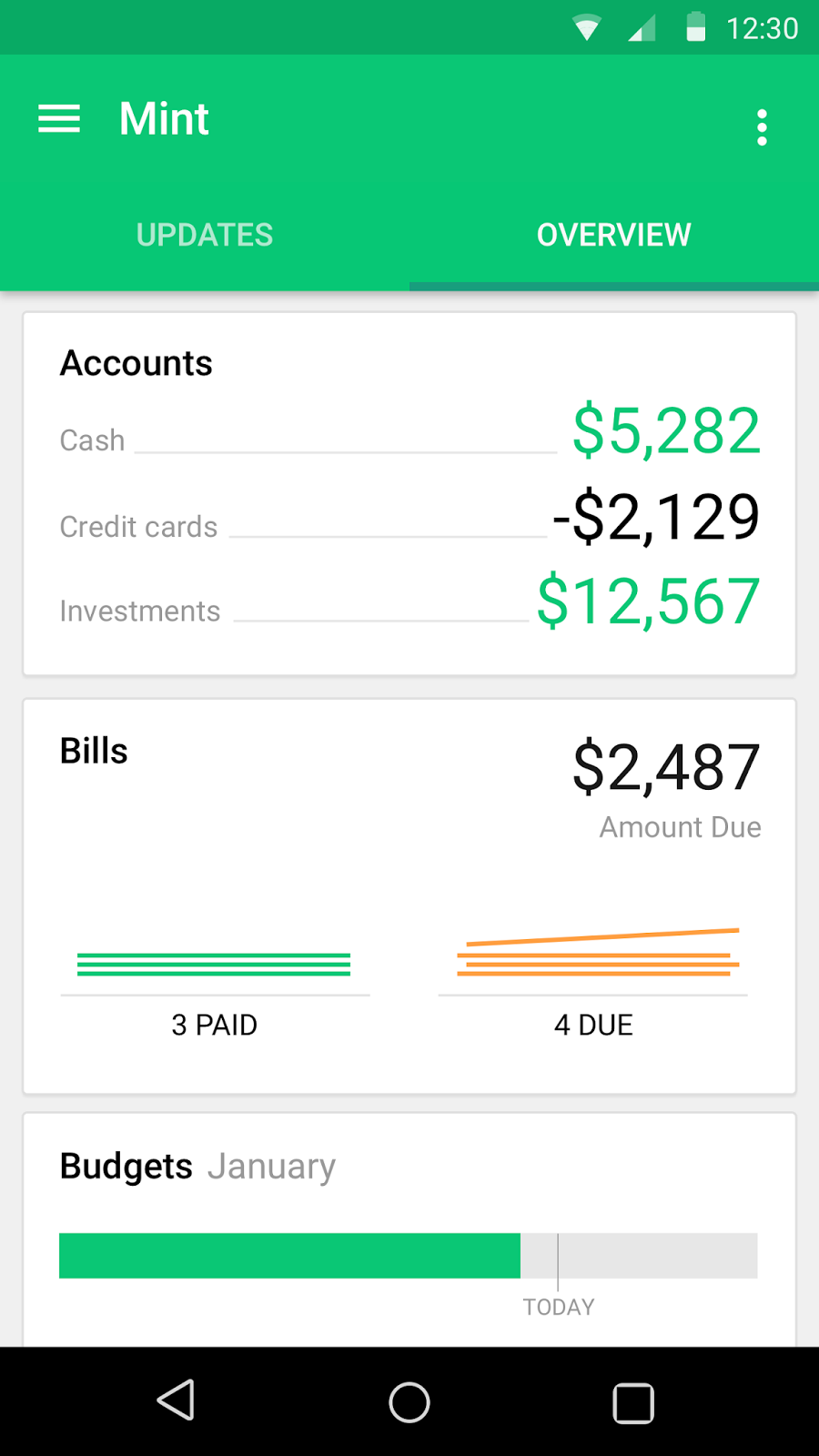

Today’s episode is a far-ranging conversation with Al Ko, Senior Vice President and Managing Director of the Consumer Ecosystem at Intuit. Among other things, he heads up Mint, which is deeply innovating about healthier ways for us to live our financial lives.

Al reminds us that Intuit founder Scott Cook pioneered PFM -- personal financial management that leverages technology to simplify financial tasks (That story is recounted memorably in Eric Ries’ book The Lean Startup.) Intuit then acquired Mint. PFM tools work wonderfully, if you have the time and motivation to pay active attention. Unfortunately, though, most of us don’t. It’s been estimated that maybe two percent of people actively use PFM tools. The other 98% struggle, and juggle our many financial tasks, and sometimes drop those balls. Al says American consumers pay $77 billion a year, just in credit card late fees. Just for, basically, forgetting to send in even the minimum payment by the due date.

Fortunately, big trends are bringing new solutions are starting to make the juggling easier, or even unnecessary. Finance will still be complicated, but it will feel simple.

This is critical, because complexity is one of the main drivers of people’s financial problems and bad financial health. Financial services are just inherently complicated, intrinsically hard to understand and hard to manage. If we can make it easy, a lot of problems simply go away.

The foundational breakthrough is that technology can now easily consolidate our disparate financial information in one place, electronically. Once it’s all there, technology tools can easily organize and analyze it. Then that consolidated information can be teed up, through new PFM tools, to give us at-a-glance insight on where we stand -- comprehensively, always up to date, and also benchmarked, if we want, against our goals, like what we’re saving for, or against emerging standards that can help us know whether we’re financially healthy, or not.

Next, and crucially, new tools can also easily take the initiative to send us alerts, reminders, to do things like paying a bill, or like pausing before we make a payment that will cause us to fall short on the next rent payment. Not wait for us to look up a bill or find a statement, but initiate a reminder, in the midst of our busy lives.

Now add in behavioral science-based tools, so that, instead of being boring, our financial management can become engaging, even entertaining and fun, or even funny (see my past podcast with Digit). Behavioral science can also “hook” us on good behavior through rewards and reinforcement that are psychologically effective.

And then, as Al explains in this episode, all this will become universally accessible across all our devices. We’ll be able to get those reminders, or get our questions answered, anywhere, anytime, all the time -- in our house, our car, our phone, our watch.

And we’ll be able to do it, when we want to, just by talking. We’ll use smart voice assistants like Alexa, the Amazon Echo, or Google Home. No need to open apps, or look things up. No need, even, to find the phone, or even press a button. We’ll simply be able to speak, into the air. That may not seem like a big deal to you if you’ve been using, say, Siri, but back to the point on behavioral psychology, the tiny nuance of easiness can make a huge difference in actually using a solution.

Your voice assistant increasingly will be your full financial assistant (Capital One customers can already use Alexa for banking). If you want it to, it will greet you as your pour your morning coffee and say, “The electric bill needs to be paid today. It’s $28.” And you’ll say, “Okay, pay it.” And then you can say, “What’s my account balance?” And, “Have I saved enough for my vacation?” And, “Where am I on my savings goals?”

Now add in geolocation. For better or worse, our phones know where we are. So we’ll soon have financial apps that will send us a text, or vibrate the watch on our wrist, with a message: “I see we’re at the grocery store. We can spend $75 here today.” Or, “I see we’re walking toward the coffee shop. You asked me to remind you that this week’s latte budget has already been spent. Keep walking!”

We’ll also be able to give our assistant, our helpful bot, a personality, an avatar, with a persona that is most motivating for us, whether it’s, say, a basketball coach or a friendly dog.

As Al explains in today’s show, Mint has a new bill-pay app that already does some of these things, and it has many more tools like these on the drawing board. They are not science fiction. These technologies already exist, and innovators are working fast to bring to us.

Are there new risks in these new tools? Sure. There are risks and drawbacks in all innovations, and we should be working on addressing them.

But here’s how I view that trade off. I’ve spent my whole career working with efforts to protect and empower financial consumers through regulation. And now, I look at these new technologies and realize, these are the solutions. With tools like these (and many more that are emerging) everyone will be able to live a healthy financial life, in the sense of easily understanding and managing their money. Easy budgeting, easy bill-paying, easier saving, easier investment, easier selection of the best product, easier self-discipline -- all of it.

To make that happen, there’s a key challenge to solve for: how will tools like these become profitable enough that providers will offer them to everyone? What are the business models that will evolve, and how can we be sure they’re transparent and fair?

I talked about that with Al Ko, and about the need for consumer empowerment on using financial data, and about what Mint does today, and will be doing soon, and about its ambitious future vision around for Powering Prosperity and Financial Freedom, globally.

More information

My past podcast with Colin Walsh of Varo, which offers a financial assistant chatbot.

More for our listeners

Remember to review Barefoot Innovation on ITunes, and please sign up to get emails that bring you the newest podcast, newsletter, and blog posts, at jsbarefoot.com.

Also go to jsbarefoot.com to send in your “buck a show” to keep Barefoot Innovation going. Please also join my facebook fan page, and follow me on twitter.

Support our Podcast - Send "a buck a show"And watch for upcoming podcasts including John Ryan of Conference of State Bank Supervisors, Colleen Briggs of JPMChase, and a series I’ll be recording from the ABA Regulatory Compliance Conference in Orlando. My guests will include Andy Sandler of BuckleySandler, and also Gene Ludwig and Alistair Renee of IBM’s Watson Financial on how artificial intelligence and machine learning will transform compliance.

Last but not least, I’m now the chair of the board of CFSI, the Center for Financial Services Innovation. Be sure to join us at the Emerge conference in Austin. There’s nothing else like it!

Subscribe

Sign up with your email address to receive news and updates.

Email AddressWe respect your privacy.

Thank you!This episode currently has no reviews.

Submit ReviewThis episode could use a review! Have anything to say about it? Share your thoughts using the button below.

Submit Review