This episode currently has no reviews.

Submit Review- Podcast |

- Barefoot Innovation Podcast

- Publisher |

- Jo Ann Barefoot

- Media Type |

- audio

- Publication Date |

- Jan 30, 2017

- Episode Duration |

- 00:52:52

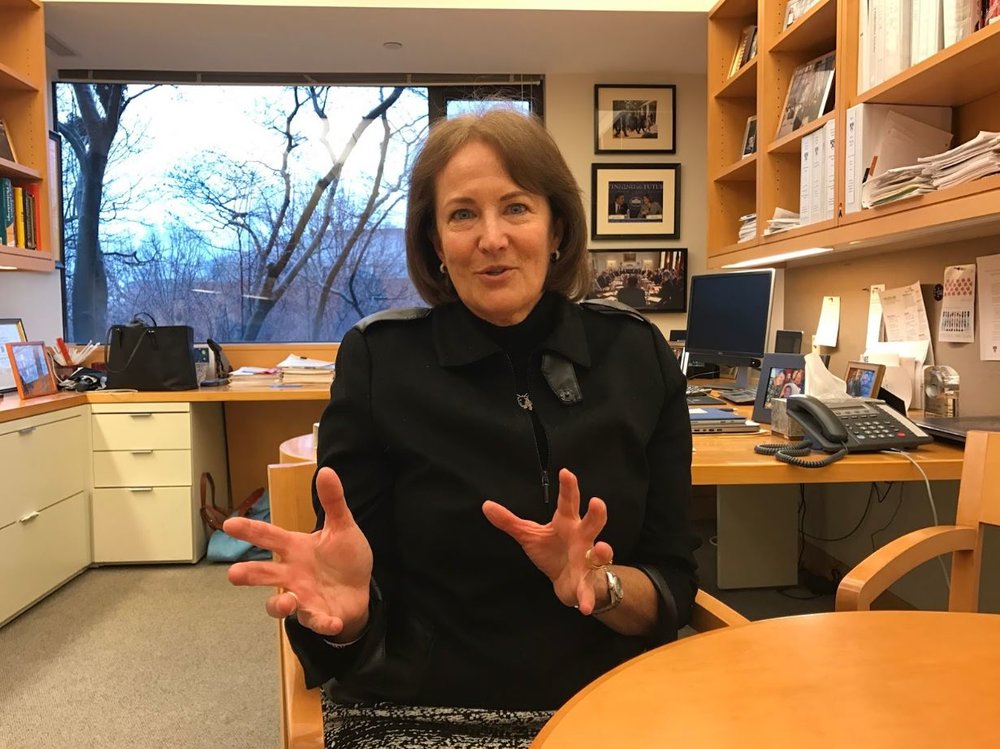

Today we’re expanding beyond our usual Barefoot Innovation focus on consumer financial innovation, to explore the parallel issues arising for small businesses. We’ve touched on this before, but are so fortunate, today, to have a guest who deeply understands the whole range of these issues. She is Karen Mills, former head of the Small Business Administration and now senior fellow at the Harvard Business School, where she has just released a comprehensive paper on fintech and small business.

We recorded today’s show in her office on the business school campus, which is just across the Charles River from my fellowship’s home base in the Harvard Kennedy School. She and I first met in Washington a few years back, when she issued a research paper on the state of small business lending. That was in conjunction with the group that issued the Small Business Borrowers’ Bill of Rights (which we covered in our episode with Brian Graham of BancAlliance. In 2016, much to my delight, Karen and her co-author Brayden McCarthy put out an 3c61-41cb-a78a-ebbe3e040e55.pdf"> update on her paper, and this time it’s mostly about fintech.

Technology is changing small business lending in the same ways it’s transforming consumer finance, but with different twists. On the positive side, innovators are using technology to do better for SME’s -- small and medium-sized enterprises -- by adopting low-cost online platforms, becoming much smarter about getting and using data, speeding up service, and creating a vastly better user experience than was possible in the past. The data issue is crucial. Thanks to new technology (including Square), small businesses increasingly can give lenders solid, up to date information on their financial positions and cash flows. Innovative lenders can analyze this, determine with precision what the borrower can afford, and often can create a flexible repayment schedule that works with the rhythm of the business, including seasonal ones.

These innovators are filling an enormous gap -- which Karen clearly demonstrates -- because banks just cannot profitably make the smaller loans that so many businesses need.

There are downsides, though. One is that whereas local banks interact with their business customers face to face, these new relationships are online. For lenders, this creates higher risk of fraud. And for borrowers, there is rising danger that these entrepreneurs will be harmed by confusing terms and, sometimes, by downright predatory practices online.

And here’s a little-known fact: small business borrowers have almost no regulatory protections, at least at the federal level. There is no federal regulator for small business lending, as there is for consumers, and even if there were, there are very few regulations that apply. Generally speaking, there are no requirements for standard disclosures to small business borrowers, and no rules against unfair and deceptive practices, beyond those that cover commerce in general.

This is significant, because today’s small businesses are more similar to consumers than ever before. The “1099” or “gig” economy has led to more and more people starting small businesses as their main work, or to supplement tight household budgets, or to tide them over after losing a job. It’s a mistake to assume that, simply because they’re business people, they are therefore financially sophisticated.

Listeners to Barefoot Innovation have probably figured out by now that I’m not a fan of the current regulatory apparatus for protecting financial consumers (even though I myself have been involved in developing some of it). Broadly speaking, disclosures are failing, and regulations are choking desirable innovation. The last thing I think we should do is to transplant our whole system of consumer protection laws into the fresh, green field of small business lending, and have it put down roots there -- like crabgrass. I think we should be deeply rethinking our consumer laws. In the process, though, we should also be thinking about whether and how to create protections and tools for small businesses to use, too.

Karen does recommend extending some consumer-type protections to these firms, including APR’s (we had a good exchange on the pros and cons of that). She also has tremendous insights into the structure and nature of the market, and on what to do about what she calls the “spaghetti soup” of regulatory agencies and rules, which now make it so hard to move toward a smarter system.

She focuses, too, on the critical need for clearer, updated regulatory guidance for banks that want to work with fintechs on small business lending. A wide spectrum of new models are emerging, partly because these two industries need each other -- they complement each other. Both sides will suffer, and so will business borrowers, if banks can’t navigate the third-party risk rules of their prudential regulators. (As I often say, the regulators have the hardest job in all this.)

More information on Karen:

Karen Gordon Mills served as the Administrator of the U.S. Small Business Administration from 2009 until August 2013. She is currently a Senior Fellow at the Harvard Business School and at the Mossavar-Rahmani Center for Business and Government at the Harvard Kennedy School focusing on U.S. competitiveness, entrepreneurship and innovation.

As SBA Administrator and a Cabinet member, Mills served on the President’s National Economic Council and was a key member of the White House economic team. At the SBA, she led a team of more than 3,000 employees and managed a loan guarantee portfolio of over $100 billion. Mills is credited with turning around the agency during the financial crisis and with streamlining loan programs, shortening turnaround times, and reducing paperwork. In addition, Mills helped small businesses create regional economic clusters, gain access to early stage capital, hire skilled workers, boost exports, and tap into government and commercial supply chains.

Prior to the SBA, Mills held leadership positions in the private sector, including as a partner in several private equity firms, and served on the boards of Scotts Miracle-Gro and Arrow Electronics. Most recently, she was president of MMP Group, which invested in businesses in consumer products, food, textiles, and industrial components. In 2007, Maine Governor John Baldacci appointed Mills to chair Maine’s Council on Competitiveness and the Economy, where she focused on regional development initiatives, including a regional economic cluster with Maine’s boatbuilding industry.

Mills earned an AB in economics from Harvard University and an MBA from Harvard Business School, where she was a Baker Scholar. Additionally, she is a past vice chair of the Harvard Overseers, and is currently a member of the Council on Foreign Relations and the Harvard Corporation.

And listen, too, to our episode from last year with Sam Hodges of Funding Circle, a leading example of platform lending to small businesses.

More for our listeners

We have some amazing shows coming up, including one with Chase’s Colleen Briggs, several focused on global trends, at least one with a CEO of a community bank, and one that I will call a barn-burner with the former CEO of PayPal and Inuit, Bill Harris. Don’t miss them!

Remember to write a review of Barefoot Innovation on ITunes, and please sign up at www.,jsbarefoot.com to get email notices when new podcasts come out, as well as my newsletter and blog posts. Go there too to send in your “buck a show” to keep Barefoot Innovation going. And remember to join my facebook fan page and follow me on twitter.

Support the PodcastThanks so much for listening, and I’ll see you next time!

Subscribe

Sign up with your email address to receive news and updates.

Email AddressWe respect your privacy.

Thank you!This episode currently has no reviews.

Submit ReviewThis episode could use a review! Have anything to say about it? Share your thoughts using the button below.

Submit Review